Why you should stop investing in Fixed Deposits immediately...?

Today we will discuss why you need to stop investing in bank fixed deposits.

I know you are a bit shocked with this statement, but my only attempt is to give you some understanding of why banks fixed deposits are not the best financial products in these times for your long term wealth creation. There are other better alternatives today if your focus is assurity of returns, near inflation returns and convenience of investing

You can either read the article, or just watch this 10 min video below where I have share why you should avoid investing in fixed deposits.

Why we create Fixed Deposits?

Since our childhood, I think most of us have only heard about Fixed deposits and PPF as the investments products. We saw our parents talking about fixed deposits all the time. They broke “FD” when they needed sudden money.

And FD’s become were like the default financial product for most of us and when we started earning, we just created fixed deposits because that’s all we knew about.

On top of it, the fixed deposits comes with assured returns of 7-8% (though the FD rates are going down and down these days). Also almost all the banks offer the online fixed deposits creation (not breaking it) and that fact also adds to our love to creating fixed deposits whenever we need to park our money for some months/years

But, now there is a great alternative for fixed deposits called as Debt Mutual Funds. This article will focus more on fixed deposits disadvantage and we will touch upon debt mutual funds to some level, but this is not a deep tutorial on debt funds

TWO big problems with fixed deposits

The 2 biggest issues which make fixed deposits very lousy products for our long term wealth creation are as follows

a) High Tax on FD – Fixed Deposits do not have any special taxation benefits. If you are into 30% tax bracket, you will have to pay the tax on the interest you earn in a year as per your tax slab.

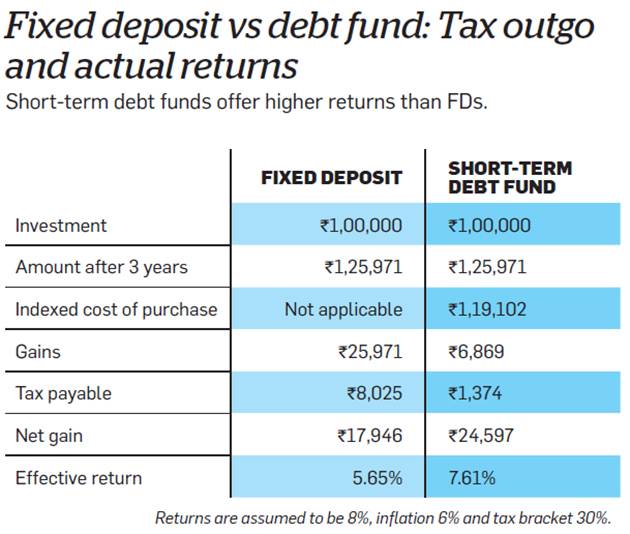

So if you create a Rs 10 lacs FD and you earn Rs 80,000 in interest (@8%) then you pay Rs 24,000 as the tax if you fall in the highest tax bracket. That’s not the case with Debt mutual funds. While debt mutual funds are not tax free, their taxation is much better compared to a fixed deposit.

The video below explains how fixed deposits taxation is different compared to a debt mutual funds.

b) No real returns – While you get 8% return on fixed deposits, it’s just artificial .. because after inflation and taxes, you are just left with a negative real return of 1-2%. So while you Rs 100 become Rs 108 after a year, you are not able to purchase the same thing after a year because it would not cost Rs 100 , but Rs 110 by now (On an average)

Now, lets look at debt funds and what they are and how they compare with fixed deposits

What are Debt Mutual Funds?

There is a big myth among investors community that mutual funds always means risky investments because they are linked with stock market, however it’s far from truth.

Debt mutual funds are a good alternative to fixed deposits. Debt mutual funds are financial products offered by AMC’s which pool the money from investors and invest in highly secured instruments like govt bonds, certificate of deposits, and other highly secured bonds in which a single investor cant invest on its own.

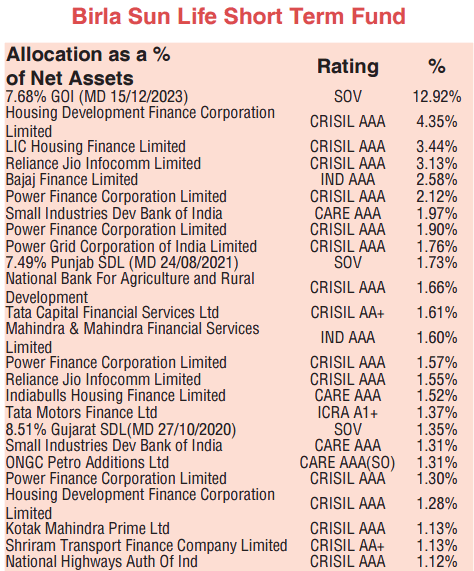

As an example, here is a sample top holding of a “Birla Short term fund” as per their factsheet

If you have done your mutual funds KYC, then investing and redeeming from debt mutual funds is online and very easy.

Debt funds also offer indexation benefits which means that you only pay tax when you redeem them unlike fixed deposits and you also pay tax on a lower rate (generally 20% after indexation). Below is a comparison by Economic times article on the taxation aspect of fixed deposits vs. a debt fund

When do Fixed Deposits make sense?

Fixed deposits can still be considered when you want to park your money for a short term period like 1 yr or 6 months and don’t want to go with mutual funds and also dont care about that extra 1-2% return. I think those investors who are trying to save money for the first time can look at fixed deposits or recurring deposits as open to start with.

SIP in Debt funds

If you are looking for an alternative of a recurring deposit, then SIP in debt mutual funds are the best option. The best part is that you can also top up your additional investments whenever you want unlike a RD in the bank.

Don’t use fixed deposits for long term wealth creation

While investing in a fixed deposits for a short term period is still ok, it’s strictly a no no if you are investing for long term financial goals like retirement or children education or something. The positives of fixed deposits over long term are just few compared to the negatives. Fixed deposits or recurring deposits are tools to just “save the money” and not wealth creation.

At best they can preserve your money purchasing power, but cant create big wealth for you (after adjusting for inflation and taxes)

So try learn more about debt funds, they are not at all that scary and much more easier to invest and maintain then you imagine. If you are looking to try out your debt mutual funds investments, our team can talk to you and help you save your money in debt mutual funds, Just fill up this form and we will call you

Let us know if you want to know anything about this topic ? Please post your comments and thoughts if any..

Comments

Post a Comment